Client Alert: Upcoming changes to the unfair contract terms legislation

- Gibson MacNeill Team

- Oct 7, 2023

- 5 min read

On 9 November 2023, significant amendments to the unfair contract terms (UCT) regime will come into effect. The new provisions were introduced to protect small businesses and consumers with limited bargaining power from being disadvantaged by unfair contract terms. These changes will increase the scope of the regime and applicable penalties.

It is critical that your business understands the amendments, the potential impact of the amendments, and what your business can do to comply. This alert summarises the changes to the UCT regime, identifies affected businesses, defines “unfair term,” outlines the enforcement mechanisms, suggests steps your business can take to comply, provides a comparison of key current and new UCT provisions, and explains how Gibson MacNeill Lawyers can assist.

Key Points

If your business issues standard form contracts to consumers and/or small businesses, those contracts should be immediately reviewed for unfair terms and, where necessary, removed or amended.

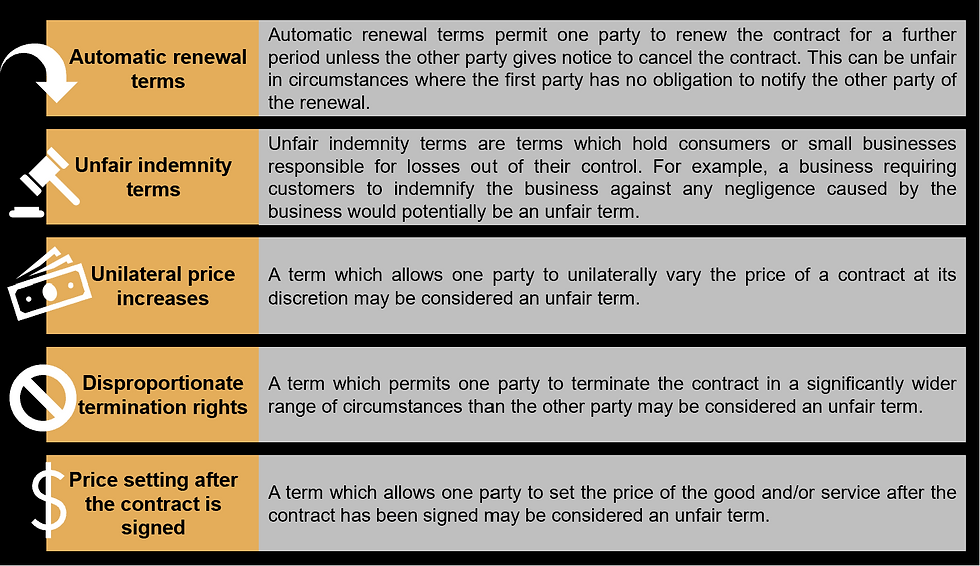

Unfair contract terms include: automatic renewal terms (in circumstances where one party has no obligation to notify the other party of the renewal); and indemnity terms (which hold consumers or small businesses responsible for losses out of their control).

Unfair terms in a consumer or small business standard form contract may expose the contravening business to substantial pecuniary penalties.

If a consumer or small business is a party to a standard form contract that contains unfair terms, the individual or small business may: raise the concern with the breaching party; notify the Australian Competition and Consumer Commission (ACCC), state or territory regulators (such as the Office of Fair Trading (OFT)) or, if the contract is for the supply of financial goods and/or services, the Australian Securities and Investments Commission (ASIC); or commence private action in court to enforce their rights under the regime.

The ACCC, state and territory regulators and ASIC have power to independently apply to the court to seek orders against a breaching party under the regime.

The changes apply to consumer and small business standard form contracts made or renewed on or after 9 November 2023.

Overview

Last year, the Treasury Laws Amendment (More Competition Better Prices) Act 2022 (Cth) received royal assent. It amends the UCT provisions in both the Australian Consumer Law (ACL) (Schedule 2 to the Competition and Consumer Act 2010 (Cth)) and the Australian Securities and Investments Commission Act 2001 (Cth).

Currently, the UCT regime allows individuals and small businesses to apply to a court to have a term of a standard form contract they entered into be declared unfair thus unenforceable. However, the regime was found to provide little incentive for businesses to comply with the law.

The amendments were introduced to reduce the prevalence of unfair terms in consumer and small business standard form contracts. Namely, the amendments strengthen the remedies and enforcement regime by:

prohibiting the proposal of, use of, application of, or reliance on, unfair contract terms in standard form contracts;

expanding the definition of “small business”;

creating new pecuniary penalty provisions for breaches of the prohibitions;

clarifying the factors that the court must consider when determining whether a contract is a standard form contract; and

clarifying the powers of the court to determine an appropriate remedy for breaches of the UCT regime.

What is an unfair term?

The amendments to the UCT regime will not change the meaning of “unfair term”. A term is considered unfair if it meets each of the following three limbs:

It would cause a significant imbalance in the parties’ rights and obligations arising under the contract.

It is not reasonably necessary in order to protect the legitimate interests of the party who would be advantaged by the term. This limb requires the court to consider whether there is reasonable justification for the imbalance.

It would cause detriment (whether financial or otherwise) to a party if it were to be applied or relied on.

Previous case law has provided guidance on the types of provisions likely to be found “unfair”. These include the following:

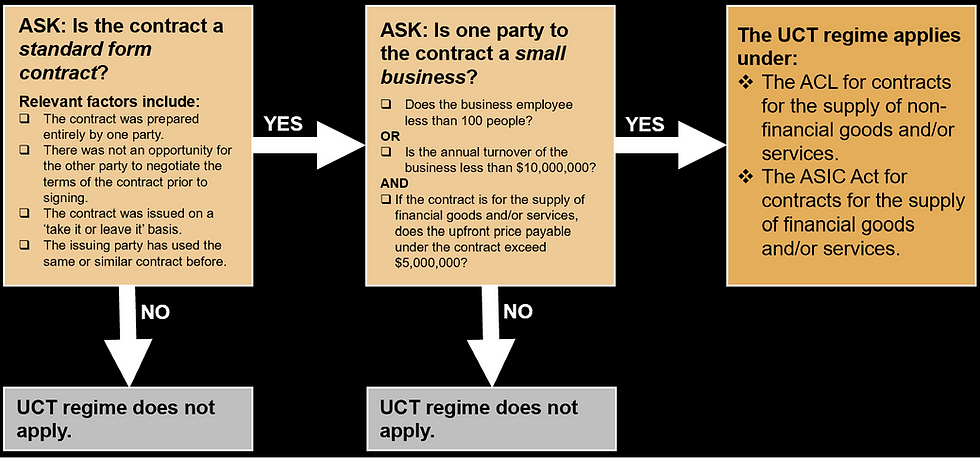

Is your business affected?

The amendments affect businesses that use standard form contracts in dealings with consumers and/or small businesses to:

supply goods and/or services;

sell or lease land; or

supply financial services or financial products.

The amendments considerably expand the class of businesses that will be captured by the definition of “small business”. Under the amendments, a business is a “small business” if it:

has less than 100 employees; or

has an annual turnover of less than $10,000,000.

Additionally, to fall within the new UCT regime under the ASIC Act, the contract must be for financial goods and/or services where the upfront price payable of the contract does not exceed $5,000,000.

The amendments also clarify the definition of “standard form contract”. Factors which indicate the existence of a standard form contract include:

the contract was prepared entirely by the dominant party;

there was not an opportunity for the other party to negotiate the terms of the contract prior to signing;

the contract was issued on a ‘take it or leave it’ basis;

the dominant party has used the same or similar contract before.

Gyms, vehicle rentals, travel insurance companies and telecommunication services are all examples of industries which issue standard form contracts to their customers.

Effective date

The new regime will apply to standard form contracts that are made or renewed on or after 9 November 2023.

Enforcement

If you are a consumer or small business and you find an unfair term in a standard form contract, the following options are available to you:

Raise the concern with the contract provider to see if they can resolve the issue (for example, by amending or removing the term). This option could save you or your business time and money.

If the contract is for the supply of non-financial goods and/or services, make a complaint to the ACCC or the state or territory consumer protection agency (such as the OFT). If the contract is for the supply of financial goods and/or services, complaints should be made to ASIC.

Bring an independent court action against the breaching party. Proceedings for unfair contract terms can be complex and we recommend you seek legal advice first.

The ACCC, consumer protection agencies and ASIC may also independently take action against a breaching business. These bodies can negotiate with businesses to have unfair contract terms removed or amended from consumer or small business standard form contracts. These bodies may also bring an action against a breaching business in court.

In its 2023-24 Compliance and Enforcement Priorities, the ACCC has indicated that it will be prioritising enforcement of the UCT regime. We expect that the ACCC will be active in initiating proceedings against businesses in breach of the new provisions in order to establish the legal parameters of the amendments.

What your business should do

In the lead up to the commencement of the changes, there are a number of things your business can do to ensure compliance:

Businesses are urged to carefully review their standard form contracts with small businesses and consumers for potential unfair terms. If any terms are found to be unfair, they should be amended or removed.

Businesses should identify commercial partners who may fall within the amended definition of “small business” and ensure standard form contracts with these partners do not contain any unfair terms.

Businesses should seek legal advice if unsure whether a standard form contract with an individual or small business will comply with the new laws.

New vs current law: comparison

The below table summarises the key differences between the current and new UCT provisions that businesses should be aware of:

Current law | New Law |

Definition of small business | |

Under the ACL, the UCT regime currently only applies to “consumers”. There is no specific reference to “small businesses”. Under the ASIC Act, the UCT regime currently only applies to a small business contract for the sale of financial goods and/or services if:

| Under the ACL, the protections will apply to a small business contract for the sale of non-financial goods/and or services if one party to the contract is a business that:

Under the ASIC Act, the protections will apply to small business contract for the sale of financial goods and/or services if:

Under both the ACL and ASIC Act, part time employees count as an appropriate fraction of full-time equivalent employees. |

Standard form contract | |

In determining whether a contract is a standard form contract, a court must take into account a number of matters including:

| In addition to the current matters, the court must take into account whether one of the parties has used the same or a similar contract before. |

N/A. | A contract may be determined to be a standard form contract even if:

|

Pecuniary penalties | |

No pecuniary penalties under the existing regime. | A pecuniary penalty may be imposed if a person proposes, applies, relies or purports to apply or rely on, a UCT. For companies, the maximum penalty for contravention will be the greater of:

For individuals, the maximum penalty is $2,500,000. |

Court powers | |

The court can:

| The court can:

|

How GML can assist

The team at Gibson MacNeill Lawyers offers a wealth of experience and expertise in commercial and business matters. At GML, we are well equipped to help your business understand the changes to the UCT regime and can assist in reviewing any standard form contracts for potential unfair terms and removing or amending those terms where necessary.

If you think the UCT regime changes may affect your business, you are welcome to reach out to the GML team who will offer tailored legal advice to address your specific concerns and assist your business in reaching its best commercial outcome.

Scott MacNeill – Managing Director

Gibson MacNeill Lawyers

.png)

Comments